Earth Day 2025

Earth day is a global event which aims to highlight the importance of protecting the environment, first set up in 1970. This ...

Read MoreFrom today, participating lenders in the Bounce Back Loan Scheme (BBLS) are able to offer smaller businesses across the UK a ‘top-up’ to their existing Bounce Back Loan if they originally borrowed less than the maximum amount available to them.

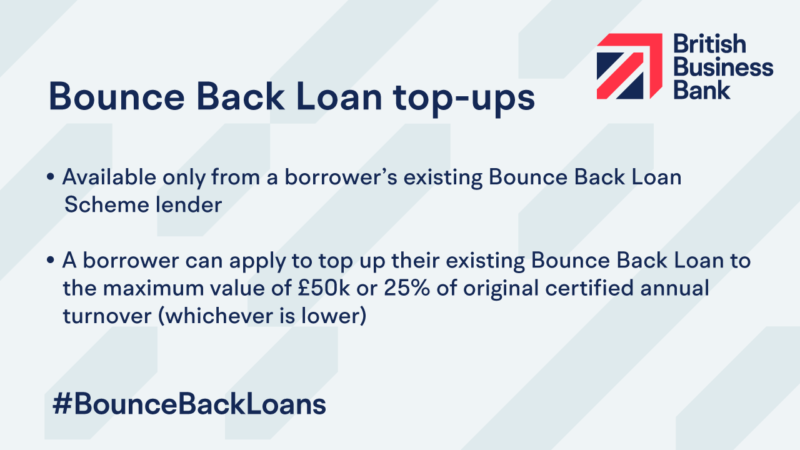

The Bounce Back Loan top-up will be available from several large lenders from today, with other lenders anticipated to make the top-up available in due course.

The top-ups are only available from a borrower’s existing BBLS lender. A borrower can apply for a top-up that is for the lesser of £50k or 25% of the annual turnover the borrower certified in their original successful BBLS application form, minus the value of their original loan.

Worked examples

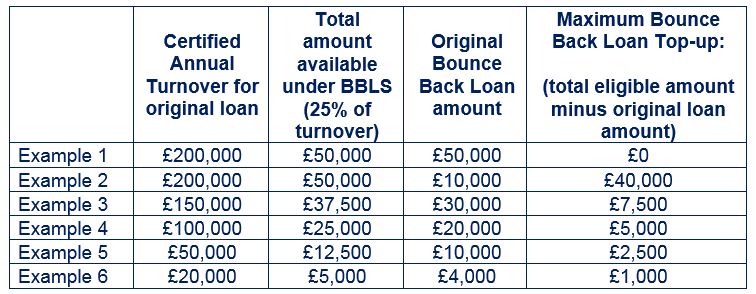

Under the Bounce Back Loan Scheme top-up, if a borrower had certified an annual turnover of £100,000 in their original application and taken a Bounce Back Loan of £20,000 (20% of that certified annual turnover), they can ask to borrow an additional £5,000 (5% of that certified annual turnover), taking their Bounce Back Loan to the maximum 25% of their originally certified annual turnover.

Varying turnover amounts certified in original loan applications and relative size of original loans means the size of the top-up facility available to applicants will vary – examples:

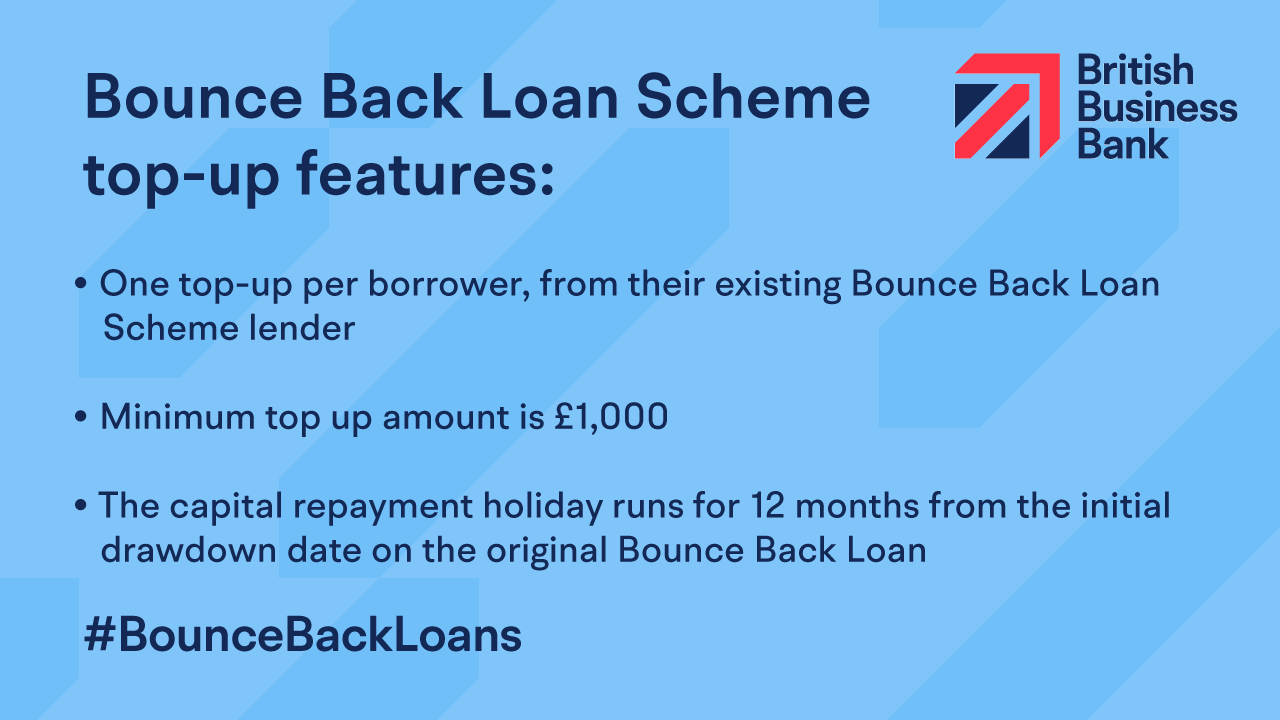

Bounce Back Loan Scheme top-up features

– One top-up per borrower from their existing lender

– Minimum top up amount – £1,000

– The capital repayment holiday runs for 12 months from the initial drawdown date on the original Bounce Back Loan.

For example, if the initial drawdown date of the original Bounce Back Loan was on 1 June 2020, and the drawdown date of the top-up was on 1 November 2020, the capital repayment holiday period will run to 31 May 2021

How to apply

A short form template application form will be available from the Bounce Back Loan Scheme accredited lenders. Borrowers must complete this application form to be eligible for a top-up.

The top-up application form will require borrowers to indicate the amount of the top-up requested and re-provide certain declarations set out in the original Bounce Back Loan application form.

Further details and conditions are available on the Bounce Back Loan Scheme page on the British Business Bank website.

Earth day is a global event which aims to highlight the importance of protecting the environment, first set up in 1970. This ...

Read MoreWe are excited to announce that the Lincolnshire Chamber of Commerce has officially launched the process to select our Charit...

Read MoreLog into your account

If you have difficulty logging in, please reset your password. If you continue to experience issues, please email marketing@lincs-chamber.co.uk