Earth Day 2025

Earth day is a global event which aims to highlight the importance of protecting the environment, first set up in 1970. This ...

Read MoreEast Midlands businesses accounted for just 4% of administrations in the first six months of the year – the joint third lowest region in the UK – according to analysis by full-service law firm Shakespeare Martineau.

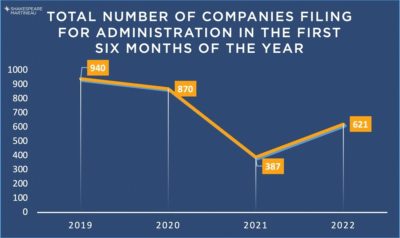

More than 620 businesses, 28 of which came from the East Midlands, filed for administration between 1 January and 30 June 2022, marking a 60% increase compared to 2021. Construction, manufacturing and retail were the sectors worst hit, accounting for 40% of administrations.

Greater London led the way with 22% of the filings, followed by the South East (17%) and North West (15%). The East Midlands sat in sixth place alongside Scotland and Wales, data from The Gazette Official Public Record has revealed.

Duncan James, partner and regional head of Shakespeare Martineau in the East Midlands, said: “The East Midlands placing so low in the rankings shows how robust the region is, which is likely due to the diverse nature of business types – with many major international players, British household brands and innovative start-ups situated here.

“However, the headwinds are still of concern and the East Midlands is far from immune from economic challenges such as inflation, interest rate rises and skills shortages. With this in mind, it continues to be vital that business leaders seek early advice on cash flow and trading positions to avoid falling victim to sustained pressure.”

While administrations nationally are still yet to hit pre-Covid levels (940 in the first six months of 2019), recession fears and the financial pressure on households and businesses means the worst is still yet to come, an insolvency and restructuring expert has warned.

Andy Taylor, partner and head of restructuring at Shakespeare Martineau, said: “Administrations were suppressed during Covid due to the introduction of numerous measures, such as the Coronavirus Business Interruption Loan Scheme, the subsequent Recovery Loan Scheme and a general prohibition on many forms of enforcement.

“As those support packages have been removed, we have seen an increase in insolvencies generally, which is to be expected.

“Businesses are facing numerous headwinds – from inflation and interest rises to the challenging political landscape at home and further afield. There are a lot of businesses with endemic problems they have been sitting on for months and, in some cases, years. If things continue as they are, we expect to see an increase in business failures as they attempt to address their underlying issues and battle tough trading conditions.

“We’re also anticipating the banks will review their portfolios and it may be they will be taking a more cautious approach to lending decisions in the short to medium term. We are also seeing more enforcement and less flexibility from HMRC.

“There is no doubt a rocky road ahead – with some commentators predicting a demand-led recession, which looks very different to what we experienced coming out of Covid.”

Skills shortages, supply chain issues and ever-rising costs of materials and energy are plaguing the construction and manufacturing sectors, while inflation and competition from online retailers are affecting the retail sector.

Andy said: “There is a lot of pressure on the construction industry generally and we are also seeing problems on the high street in terms of consumer spending, which is not going to improve with inflation running to 9% at present.

“According to our analysis, the utilities sector only accounted for 3% of administrations in the first half of 2022. However, we do know there has been numerous energy company failures in the past 18 months due to huge problems in the market, and we expect to see further consolidation in the energy sector over the coming months.”

While January (55) was the quietest month, administration numbers leapt to 140 in March – the most recorded for 15 months – before dipping to 120, 93 and 104 in April, May and June respectively.

Andy said: “I suspect the spike in March highlights a degree of lag as businesses began looking at their trading and profitability as we emerged from the pandemic and the Covid measures started to end.

“It is interesting that the number of businesses filing for administrations after March started to drop off again. This is counter-intuitive because there is still extreme uncertainty and economic pressure. June figures have started to increase again and initial indications are that July will follow a similar pattern.

“There are many businesses in a state of flux and for them to survive longer term, they will need to act now to address underlying issues. Taking a proactive approach can help directors to keep their business afloat. I cannot overstate how important it is to get to grips with matters at the earliest possible juncture and to take the appropriate professional advice if required.”

Earth day is a global event which aims to highlight the importance of protecting the environment, first set up in 1970. This ...

Read MoreWe are excited to announce that the Lincolnshire Chamber of Commerce has officially launched the process to select our Charit...

Read MoreLog into your account

If you have difficulty logging in, please reset your password. If you continue to experience issues, please email marketing@lincs-chamber.co.uk