Earth Day 2025

Earth day is a global event which aims to highlight the importance of protecting the environment, first set up in 1970. This ...

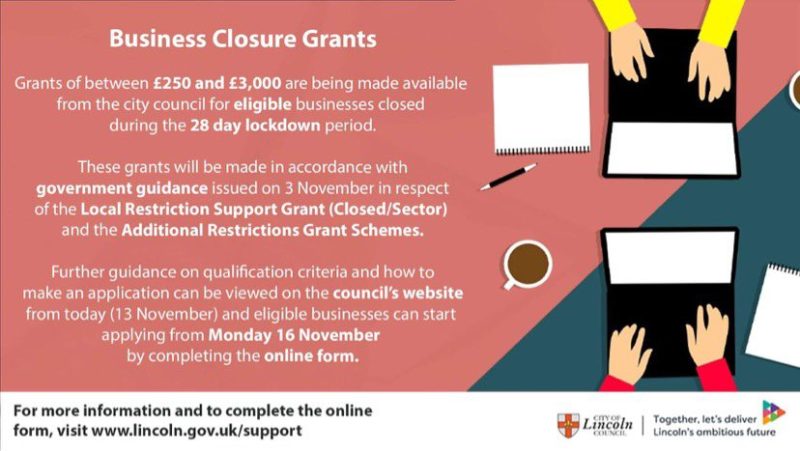

Read MoreGrants of between £250 and £3000 are available from the City of Lincoln Council for eligible closed businesses during the 28 day lockdown period until 2nd December 2020.

These Grants will be issued in accordance with Government Guidance issued on 3rd November 2020 in respect of the Local Restriction Support Grant (LRSG Closed/Sector) and the Additional Restrictions Grant (ARG) Schemes, along with guidance on required closures.

Any updated Government guidance or FAQs subsequently published by Government in respect of these schemes will also apply.

Eligible businesses will be able to apply online from Monday 16th of November 2020 via the council’s website here.

Click here to download the Council’s Closed Business Grant Support Policy which sets out all information businesses need to know.

Qualifying Criteria

For Businesses that have a separate business rates account to qualify for the Local Restrictions Support Grant, businesses must:

– have been open as usual and providing in-person services to customers from their business premises on the 4th of November 2020 and then mandated to close by Government from 5th November 2020, or

– still be closed due to national restrictions imposed on 23 March 2020 as a result of regulations made under the Public Health (Control of Disease) Act 1984 i.e. nightclubs, dance halls, discotheques, sexual entertainment venues and hostess bars.

– And have been registered and be the liable business rate payer on 5th November 2020.

Where a hereditament has mixed premises and only part of the business is subject to national closures (e.g. locksmith/shoe repairs, restaurant/takeaway), the hereditament will be eligible to receive a LRSG grant if the business is required to close its main service. Local Authorities will be required to exercise their discretion and judge whether this is the case based on their local knowledge.

Businesses that are required to close but then diversify to remain open in part e.g. restaurants/cafes that close but retain a takeaway service or shops that close but retain a click and collect facility will still be eligible for a grant.

For Businesses that don’t have a separate business rates account to qualify for the Additional Restrictions Support Grant, businesses must:

– have been open as usual and providing in-person services to customers from their business premises on the 4th of November 2020 and then mandated to close by Government from 5th November 2020 .

– And be able to evidence non business rates, rent or mortgage costs above the minimum cost threshold outlined below for a building or premises which has a primary business purpose or trading use.

It is expected that such businesses fall into one of, but not restricted to, the following categories:

– small businesses in shared spaces that don’t have a separate business rates account

– regular market traders (indoor or outdoor) with fixed property costs

– self-employed who rent a space in a property that is registered for business rates (for example: a hairdresser renting a chair)

– overnight accommodation providers and public houses

Earth day is a global event which aims to highlight the importance of protecting the environment, first set up in 1970. This ...

Read MoreWe are excited to announce that the Lincolnshire Chamber of Commerce has officially launched the process to select our Charit...

Read MoreLog into your account

If you have difficulty logging in, please reset your password. If you continue to experience issues, please email marketing@lincs-chamber.co.uk